College Basketball

Tennessee basketball in battle with SEC rival for top guard

Earlier this week, Rick Barnes stated that Tennessee basketball is not in a rush to…

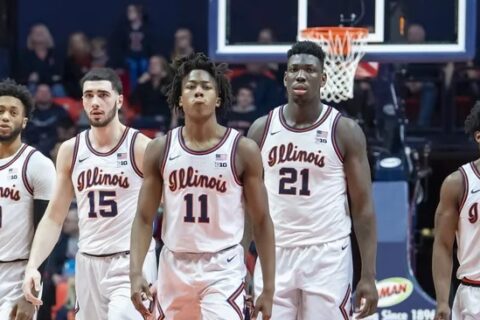

Illinois Basketball Lands High-Upside European Big Man

Over two thousand collegiate men’s basketball players transferred to other universities. Since its launch on…

College Football

College football Star Johnny Manziel predicts NCAA’s demise

During his time, Johnny Manziel was one of the most well-liked college football players. During…

LSU Football offers 2026 EDGE from Pensacola, Florida

Traveling to Pensacola, Florida, Brian Kelly and his recruiting staff extended an offer to a…

Boxing

Lomachenko knocks out Kambosos to win IBF lightweight crown

Before Kambosos was eliminated early in the eleventh round, the Ukrainian showed to be the stronger fighter through ten rounds. ... Read more

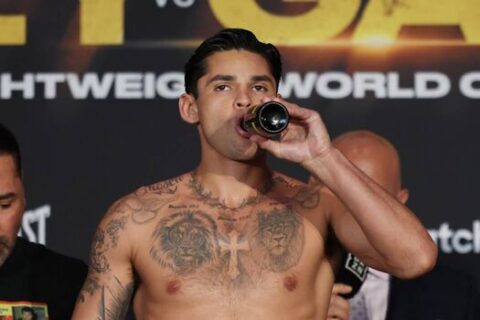

Ryan Garcia’s Doping Scandal Have Emerged

Regarding the doping incident involving Ryan Garcia, the first welterweight boxer, new information has surfaced.…

Loma v Kambosos Fight: Sunday 12th May

Catch all the action of Loma v Kambosos live Boxing and loud on Sunday 12th…

Robbie Davies Jr to face Sergey Lipinets on May 8

Robbie Davies Jr. will make his US debut against Sergey Lipinets, the former world super…

Business

Sports Professionals Talk the Globalization of Sports

Sports Professionals are a global cultural mainstay and a medium that cuts across language barriers. At the fourth annual Maryland ... Read more

Posts List

Lomachenko knocks out Kambosos to win IBF lightweight crown

Before Kambosos was eliminated early in the eleventh round, the Ukrainian showed to be the…

Tennessee basketball in battle with SEC rival for top guard

Earlier this week, Rick Barnes stated that Tennessee basketball is not in a rush to…

Ryan Garcia’s Doping Scandal Have Emerged

Regarding the doping incident involving Ryan Garcia, the first welterweight boxer, new information has surfaced.…

Loma v Kambosos Fight: Sunday 12th May

Catch all the action of Loma v Kambosos live Boxing and loud on Sunday 12th…

College football Star Johnny Manziel predicts NCAA’s demise

During his time, Johnny Manziel was one of the most well-liked college football players. During…